The Department of Justice (DOJ) recently announced that more than fifty people have been criminally charged with fraudulently obtaining loans from the Paycheck Protection Program (PPP). The PPP was created by the CARES Act to provide Small Business Administration (SBA) loans to businesses and other organizations in to order keep workforces employed during the coronavirus pandemic. By the time applications for the PPP loans had closed on August 8, 2020, the DOJ noted, more than 5.2 million loans had been approved for a total of more than $525 billion.

The DOJ, with partners from the FBI, the SBA’s Office of Inspector General (OIG), the IRS, the U.S. Postal Inspection Service, and the OIGs from the FDIC and the FHFA, disclosed that the indicted fraudsters came from across the country, from no fewer than 19 federal judicial districts.

As stated by Acting Assistant Attorney General Brian Rabbitt, the wrongdoers fell into two categories. “The first category was made up of individuals – or small groups – who lied about having legitimate businesses, or who claimed they needed PPP money for things like paying their workers, but instead used it to buy splashy luxury items for themselves…like luxury cars, homes, renovations, jewelry — and even adult entertainment and gambling in Las Vegas. The second category of cases…are the coordinated criminal rings that have engaged in systematic, organized conduct to loot the PPP.

For example, two individuals arrested in Miami are alleged to have been part of a criminal ring that attempted to steal $24 million of PPP funds. And seven other individuals are alleged to have been part of a criminal ring attempting to steal and launder hundreds of thousands of dollars in PPP. The fraud by those involved adds up to

- More than $175M of Attempted Loss

- More than $70M of Actual Loss

- More than $30M of Funds Seized.

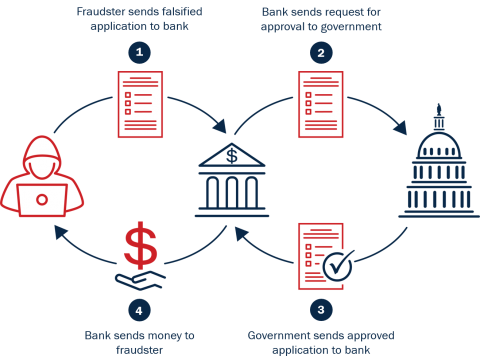

How did the fraudsters get access to PPP loans?

One of the key partners in the investigation, SBA IG Hannibal “Mike” Ware, noted that “Within 60 days of the first round of PPP loan lending, two businessmen were charged in the district of Rhode Island with allegedly filing bank loan applications seeking more than half a million dollars in forgivable PPP loans. This was the first in the nation in PPP charges. It sent a strong message that the Department of Justice, the SBA OIG and our law enforcement partners are poised and dedicated to justice and today’s announcement should only be interpreted as we will be persistent in continued pursuit of the same…. I want to assure citizens that the fraudsters will receive the whole of government response and we will relentlessly pursue evidence of wrongdoing.”

Another key partner, Jay Lerner, the IG at the Federal Deposit Insurance Corporation echoed the resolve of the strike-force team to continue combating PPP fraud. “These complex, multi-million-dollar PPP cases send a strong signal, a message of deterrence: we are determined and vigilant, and we will investigate and prosecute those individuals that defraud Government programs moving money through the banks…we will continue to help preserve the integrity of the banking sector.”

The DOJ Fraud Division has created the Paycheck Protection Program (PPP) Fraud website that displays unsealed court documents and press releases related to all individual defendants charged by the Fraud Section to date (by district). If you believe you know of potential PPP fraud, please contact the SBA Hotline or the Pandemic Response Accountability Committee’s Hotline.