Pandemic Oversight - Home

Overseeing more than $5 trillion in pandemic-related programs and spending is a big job.

Learn how we at the Pandemic Response Accountability Committee, along with others in the federal oversight community, are getting it done.

-

Image

Ask AI questions to find lessons learned about designing federal programs to focus on payment integrity and preventing fraud.

Try our new AI tool to find key insights on fighting fraud in federal programs.

-

Image

The Pandemic Analytics Center of Excellence (PACE) is changing the way watchdogs work. Learn how we’re using data in new ways to uncover fraud schemes.

We’re cracking down on fraud with advanced data analytics.

-

Image

Some businesses had their loans forgiven, others have to pay them back. Search for a borrower's name and find out more.

Whose Paycheck Protection Program (PPP) loans were forgiven?

Features

-

Image

The PRAC continues to provide innovative approaches to oversight work and deep insights into programs in ways that can be used now, and in the future. See highlights and view the full report on the work we’ve done over the latest six-month reporting period.

Report to Congress: October 1, 2024 through March 31, 2025

-

Image

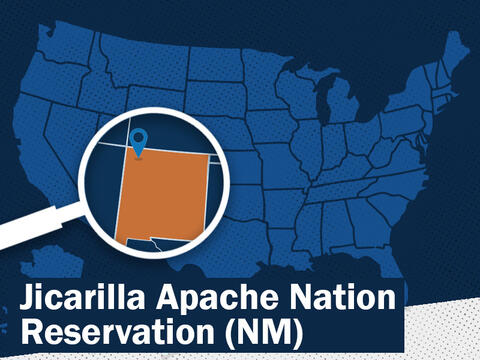

Our mission to understand communities’ experiences with pandemic funding and programs brought us to Jicarilla Apache Nation Reservation, located in New Mexico, where we gathered valuable lessons learned on how to improve federal emergency response programs in the future. Read the report to learn how this community used pandemic relief funding to respond to and mitigate the effects of COVID-19.

Focus on Community: Jicarilla Apache Nation Reservation Located in New Mexico

-

Image

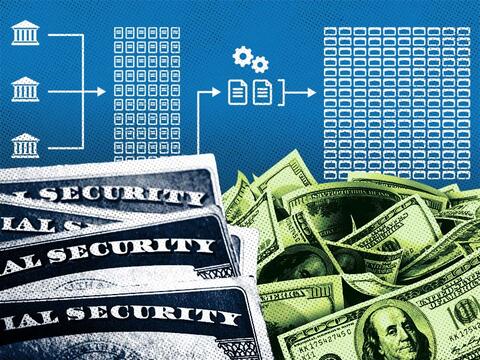

We analyzed applications across major pandemic relief programs and estimate these programs disbursed approximately $79 billion to applicants who used over 1.4 million potentially stolen or invalid Social Security numbers.

Fraud Prevention Alert: Social Security Numbers

-

Image

Using data analytics to compare income representations by applicants seeking benefits from multiple federal programs could have prevented hundreds of millions of dollars in pandemic fraud.

Fraud Prevention Alert: Income Misrepresentation

-

Image

Oversight Community and Policymakers: See how state, local, and federal governments work together to share best practices and solutions in Chapter 4 of our Blueprint for Enhanced Program Integrity. This whole-of-government approach focuses on the impact of policies and programs on government at large.

Blueprint for Enhanced Program Integrity Chapter 4

-

Image

Our mission to understand communities’ experiences with pandemic funding and programs brought us to White Earth Nation Reservation, located in Minnesota, where we gathered valuable lessons learned on how to improve federal emergency response programs. Read the report to learn how this community incorporated cultural traditions into its pandemic response and used pandemic relief funding to respond to and mitigate the effects of COVID.

Focus on Community: White Earth Nation Reservation located in Minnesota

In The News

Where did Pandemic Relief Funds Go?

This visualization and the spreadsheet do not reflect the approximately $27B in pandemic funding recalled under the Fiscal Responsibility Act of 2023, signed on June 3, 2023.

Tracking Pandemic Spending

Download the spreadsheet to get more details on the categories and funding shown above.

See the six laws that funded pandemic relief programs.

Explore the relationship between the laws and the programs they funded with our interactive visualization.