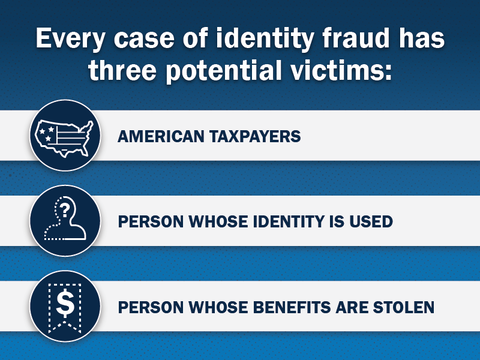

Identity fraud has been rampant during the pandemic. Our Identity Fraud Reduction and Redress Working Group—comprised of partner Offices of Inspectors General (OIG)—was established to help reduce identity fraud in government programs and help victims recover.

To compile insights for their newly-issued report, the working group's OIG partners combed through their own bodies of work to identify actions agencies are taking to reduce fraud and help victims.

Here's how they conducted their work

-

Image

The working group reviewed 55 reports, 16 of which were pandemic-related.

Reports reviewed

-

Image

The reports included a total of 191 recommendations.

Recommendations

-

Image

From there, the group identified 6 actions related to fraud reduction.

Fraud reduction

-

Image

The group also identified 3 actions related to victim redress.

Victim redress

Here's what else they found:

There’s been a lot of Identity Fraud in pandemic relief programs.

Our working group’s review shows that pandemic spending was especially vulnerable to fraud schemes for two reasons:

- Programs required minimal documentation.

- Programs were created quickly, with little time to develop effective fraud controls.

The government is taking steps to address the problem.

As of April 2022, the government has issued over 241 indictments and 110 convictions related to identity fraud in pandemic programs.

In addition to law enforcement actions, agencies like the IRS and the Centers for Medicare & Medicaid Services (CMS) have stopped relying on social security numbers (SSNs) as the primary way to verify people’s identities. About a decade ago, the IRS began issuing Personal Protection Identification Numbers (IP PIN) to create a more secure process to confirm someone’s identity. And in 2017, CMS started assigning unique, randomly generated Medicare Beneficiary Identifiers to replace SSNs and better protect Medicare beneficiaries from identity theft.

Still, the burden is on victims.

Let’s say a victim has their identity stolen, but they need benefits. That person might have to start two or more separate processes to get their identity back and receive their rightful benefits. This puts the burden on the victim to navigate two or more different benefit systems, and adds to what the White House recently called a “time tax.”

Only a few working group members have done oversight work to determine how effective agencies have been in addressing the issue of identity fraud. In a May 2021 report on identity theft in the EIDL program, the Small Business Association’s (SBA) OIG reported that SBA had no process in place for identity fraud victims to report their problem. Nor does SBA have a way to provide victims with status updates on their cases.

It was not until over a year after the Paycheck Protection Program started that SBA began to ask all participating lenders to report suspected application fraud, such as identity fraud, to the SBA OIG and the SBA Office of Credit Risk Management.

The way forward.

Government agencies continue to strive for great customer service for our citizens, a particularly important goal when responding to major disasters like the pandemic. With this report, we hope to draw more attention to the experiences of identity fraud victims and how government agencies can play a role in reducing their burden. Our role is to help ensure that fraud reduction efforts strike an appropriate balance between preventing payments to fraudsters and making sure people enrolled in benefits programs get the benefits they’re entitled to.

More report findings

More Resources

- Read the Identity Fraud Reduction and Redress Working Group’s report

- PRAC OIGs’ identity fraud reduction and redress reports can be found in the Oversight section on this website

- Relevant reports and investigations can be found on our Identity Fraud webpage